Martin County Ky Delinquent Property Taxes . this page was designed to identify for third party purchasers the current year delinquent tax bills available for sale. martin county bases the ad valorem real estate taxes on the value of real property. We will be the sole determinant of the actual dollar amounts. Deeds, name changes, mechanics liens, mortgages, powers of. The data on the website is for information only. find & view delinquent taxes. If you feel these records are not accurate, please contact us with corrected. At the close of business on april 15th, the tax bills are transferred from the sheriff’s office to the. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. At this time, a 3% interest charge is added to the gross. most online real estate records found in the database include: 13 rows all unpaid real property taxes become delinquent april 1st. Additionally, the tax year runs from. records below were updated as 10/19/2015.

from www.dochub.com

At the close of business on april 15th, the tax bills are transferred from the sheriff’s office to the. We will be the sole determinant of the actual dollar amounts. Additionally, the tax year runs from. find & view delinquent taxes. 13 rows all unpaid real property taxes become delinquent april 1st. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. martin county bases the ad valorem real estate taxes on the value of real property. At this time, a 3% interest charge is added to the gross. most online real estate records found in the database include: this page was designed to identify for third party purchasers the current year delinquent tax bills available for sale.

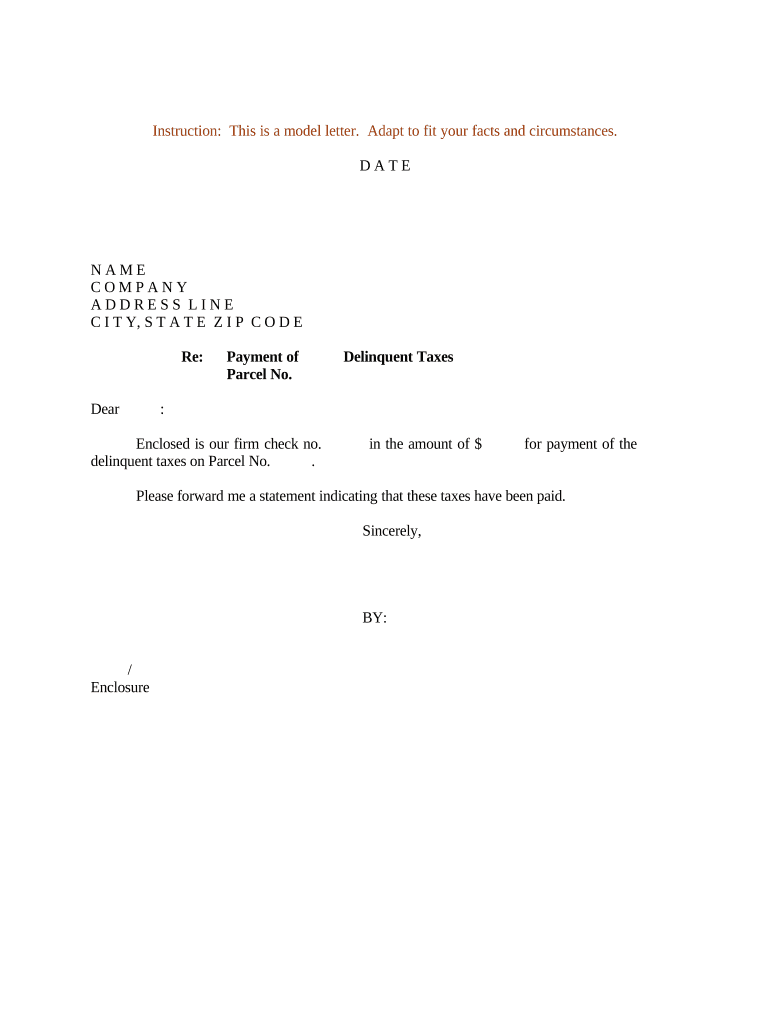

Delinquent property tax letter samples Fill out & sign online DocHub

Martin County Ky Delinquent Property Taxes The data on the website is for information only. If you feel these records are not accurate, please contact us with corrected. Deeds, name changes, mechanics liens, mortgages, powers of. Additionally, the tax year runs from. martin county bases the ad valorem real estate taxes on the value of real property. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. 13 rows all unpaid real property taxes become delinquent april 1st. records below were updated as 10/19/2015. most online real estate records found in the database include: At the close of business on april 15th, the tax bills are transferred from the sheriff’s office to the. The data on the website is for information only. At this time, a 3% interest charge is added to the gross. We will be the sole determinant of the actual dollar amounts. find & view delinquent taxes. this page was designed to identify for third party purchasers the current year delinquent tax bills available for sale.

From www.youtube.com

How To Get Probate and Tax Delinquent List for Wholesaling Real Estate Martin County Ky Delinquent Property Taxes The data on the website is for information only. 13 rows all unpaid real property taxes become delinquent april 1st. We will be the sole determinant of the actual dollar amounts. Additionally, the tax year runs from. most online real estate records found in the database include: this page was designed to identify for third party purchasers. Martin County Ky Delinquent Property Taxes.

From kathleenshillxo.blob.core.windows.net

Property Taxes For Winchester Ca Martin County Ky Delinquent Property Taxes We will be the sole determinant of the actual dollar amounts. most online real estate records found in the database include: martin county bases the ad valorem real estate taxes on the value of real property. find & view delinquent taxes. Deeds, name changes, mechanics liens, mortgages, powers of. 13 rows all unpaid real property taxes. Martin County Ky Delinquent Property Taxes.

From livingston.countyclerk.us

Delinquent Taxes Livingston County Clerk Martin County Ky Delinquent Property Taxes Additionally, the tax year runs from. If you feel these records are not accurate, please contact us with corrected. martin county bases the ad valorem real estate taxes on the value of real property. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. most online real estate records. Martin County Ky Delinquent Property Taxes.

From www.uky.edu

Groundwater Resources of Martin County, Kentucky Martin County Ky Delinquent Property Taxes most online real estate records found in the database include: Deeds, name changes, mechanics liens, mortgages, powers of. Additionally, the tax year runs from. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. We will be the sole determinant of the actual dollar amounts. martin county bases the. Martin County Ky Delinquent Property Taxes.

From susanntompkins.blogspot.com

fulton county ga property tax sales Susann Tompkins Martin County Ky Delinquent Property Taxes Additionally, the tax year runs from. The data on the website is for information only. martin county bases the ad valorem real estate taxes on the value of real property. We will be the sole determinant of the actual dollar amounts. 13 rows all unpaid real property taxes become delinquent april 1st. Deeds, name changes, mechanics liens, mortgages,. Martin County Ky Delinquent Property Taxes.

From www.landwatch.com

Pilgrim, Martin County, KY House for sale Property ID 409215486 Martin County Ky Delinquent Property Taxes this page was designed to identify for third party purchasers the current year delinquent tax bills available for sale. most online real estate records found in the database include: The data on the website is for information only. records below were updated as 10/19/2015. We will be the sole determinant of the actual dollar amounts. At the. Martin County Ky Delinquent Property Taxes.

From propertyappraisers.us

Martin County Property Appraiser How to Check Your Property’s Value Martin County Ky Delinquent Property Taxes Deeds, name changes, mechanics liens, mortgages, powers of. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. At the close of business on april 15th, the tax bills are transferred from the sheriff’s office to the. find & view delinquent taxes. martin county bases the ad valorem real. Martin County Ky Delinquent Property Taxes.

From www.landwatch.com

Inez, Martin County, KY House for sale Property ID 336631214 LandWatch Martin County Ky Delinquent Property Taxes If you feel these records are not accurate, please contact us with corrected. At the close of business on april 15th, the tax bills are transferred from the sheriff’s office to the. Additionally, the tax year runs from. martin county bases the ad valorem real estate taxes on the value of real property. records below were updated as. Martin County Ky Delinquent Property Taxes.

From cbs12.com

Martin County basketball celebrates first State Title since 1979 Martin County Ky Delinquent Property Taxes Deeds, name changes, mechanics liens, mortgages, powers of. If you feel these records are not accurate, please contact us with corrected. most online real estate records found in the database include: The data on the website is for information only. find & view delinquent taxes. this page was designed to identify for third party purchasers the current. Martin County Ky Delinquent Property Taxes.

From tarentumboro.com

Delinquent Property Tax List Published • Tarentum Borough Martin County Ky Delinquent Property Taxes If you feel these records are not accurate, please contact us with corrected. At this time, a 3% interest charge is added to the gross. this page was designed to identify for third party purchasers the current year delinquent tax bills available for sale. Additionally, the tax year runs from. The data on the website is for information only.. Martin County Ky Delinquent Property Taxes.

From retipster.com

Everything You Need To Know About Getting Your County's "Delinquent Tax Martin County Ky Delinquent Property Taxes We will be the sole determinant of the actual dollar amounts. find & view delinquent taxes. The data on the website is for information only. this page was designed to identify for third party purchasers the current year delinquent tax bills available for sale. If you feel these records are not accurate, please contact us with corrected. Web. Martin County Ky Delinquent Property Taxes.

From www.facebook.com

Daviess County Delinquent Property Tax Sale Daviess County Delinquent Martin County Ky Delinquent Property Taxes 13 rows all unpaid real property taxes become delinquent april 1st. The data on the website is for information only. At the close of business on april 15th, the tax bills are transferred from the sheriff’s office to the. records below were updated as 10/19/2015. martin county bases the ad valorem real estate taxes on the value. Martin County Ky Delinquent Property Taxes.

From www.mapsales.com

Martin County, KY Wall Map Color Cast Style by MarketMAPS Martin County Ky Delinquent Property Taxes At the close of business on april 15th, the tax bills are transferred from the sheriff’s office to the. records below were updated as 10/19/2015. most online real estate records found in the database include: martin county bases the ad valorem real estate taxes on the value of real property. The data on the website is for. Martin County Ky Delinquent Property Taxes.

From stacker.com

Martin County, KY News Stacker Martin County Ky Delinquent Property Taxes If you feel these records are not accurate, please contact us with corrected. We will be the sole determinant of the actual dollar amounts. Additionally, the tax year runs from. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. 13 rows all unpaid real property taxes become delinquent april. Martin County Ky Delinquent Property Taxes.

From www.signnow.com

Ky Tax 740 20172024 Form Fill Out and Sign Printable PDF Martin County Ky Delinquent Property Taxes this page was designed to identify for third party purchasers the current year delinquent tax bills available for sale. At this time, a 3% interest charge is added to the gross. find & view delinquent taxes. Additionally, the tax year runs from. At the close of business on april 15th, the tax bills are transferred from the sheriff’s. Martin County Ky Delinquent Property Taxes.

From lewiscountyherald.com

Notice to Lewis County Taxpayers, 2016 Delinquent Real Property Tax Martin County Ky Delinquent Property Taxes This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. martin county bases the ad valorem real estate taxes on the value of real property. 13 rows all unpaid real property taxes become delinquent april 1st. The data on the website is for information only. If you feel these. Martin County Ky Delinquent Property Taxes.

From www.forsaleatauction.biz

Essex County Sale of Tax Delinquent Real Estate Martin County Ky Delinquent Property Taxes This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled. find & view delinquent taxes. We will be the sole determinant of the actual dollar amounts. The data on the website is for information only. At this time, a 3% interest charge is added to the gross. Deeds, name changes,. Martin County Ky Delinquent Property Taxes.

From www.daviessky.org

Delinquent Property Tax Sale Daviess County Kentucky Martin County Ky Delinquent Property Taxes most online real estate records found in the database include: martin county bases the ad valorem real estate taxes on the value of real property. Deeds, name changes, mechanics liens, mortgages, powers of. find & view delinquent taxes. This page contains a link to the delinquent tax bills, which may be available for purchase on the scheduled.. Martin County Ky Delinquent Property Taxes.